Warren Buffett, the legendary investor known as the Oracle of Omaha, has inspired millions with his remarkable journey from a young boy selling newspapers to one of the wealthiest and most respected figures in the world of finance. In this blog, we delve into the timeless wisdom, core investment principles, and life lessons shared by Warren Buffett that continue to guide not just investors but anyone striving for success with integrity, patience, and purpose.

Who Is Warren Buffett?

Warren Buffett, widely known as the Oracle of Omaha, is one of the most successful investors in the world and the long-time chairman and CEO of Berkshire Hathaway. Born in 1930 in Omaha, Nebraska, Buffett displayed an early interest in business and investing, buying his first stock at the age of 11. His investment philosophy—deeply influenced by Benjamin Graham’s value investing principles—focuses on buying undervalued companies with strong fundamentals and holding them long-term.

Buffett is admired not only for his immense financial success but also for his simple, disciplined approach, ethical business practices, and humble lifestyle. His annual letters to Berkshire Hathaway shareholders are legendary, offering timeless wisdom on investing, leadership, and life. Despite his billions, Buffett lives modestly, advocates for philanthropy, and continues to inspire generations of investors around the globe with his intelligence, patience, and down-to-earth character.

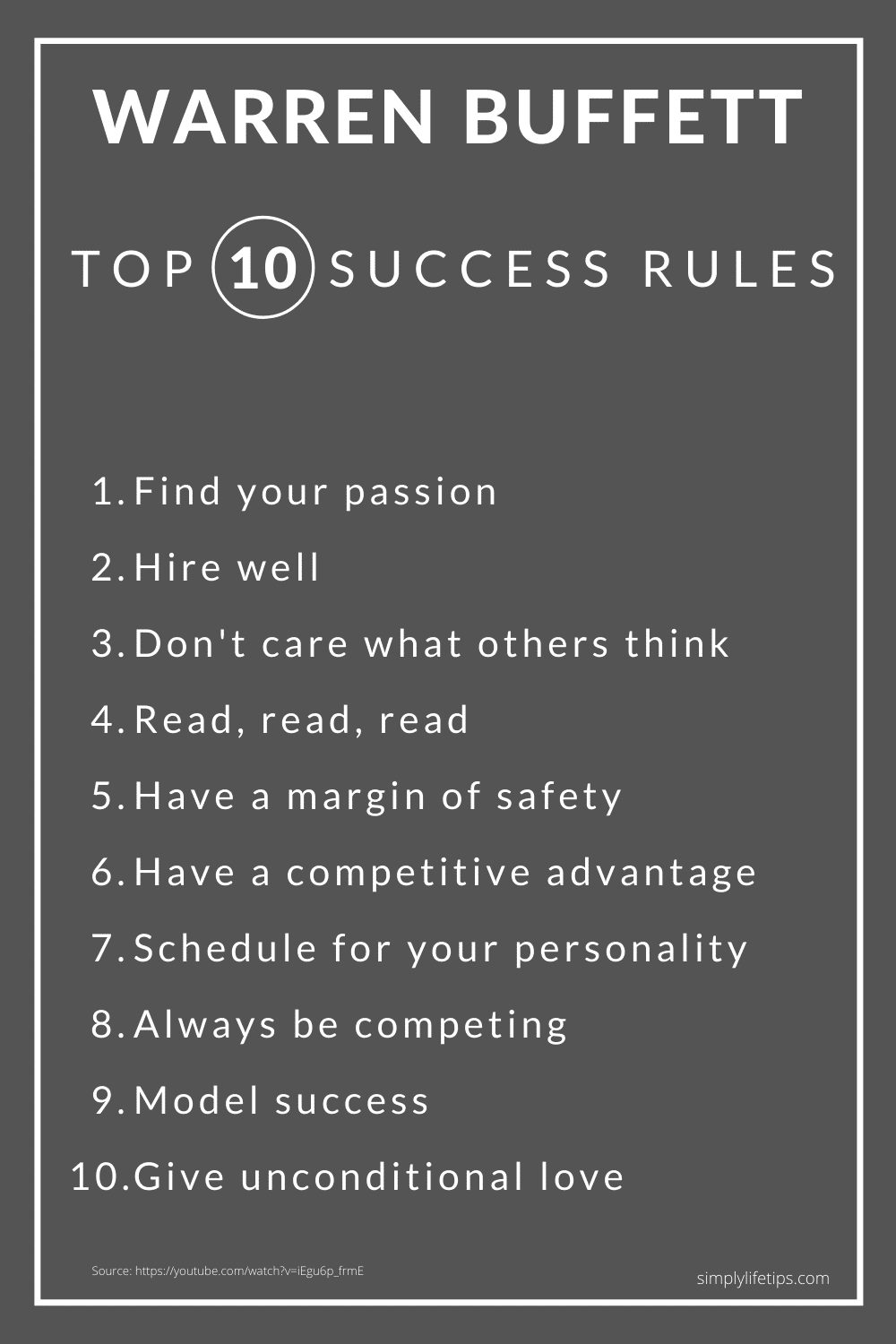

Warren Buffett – Top 10 Rules For Success

Top 10 Life and Success Lessons from Warren Buffett

Warren Buffett’s wisdom extends far beyond the stock market—his principles for living a meaningful, successful life are rooted in clarity, discipline, and timeless values. Let’s explore ten powerful lessons from the Oracle of Omaha that can transform the way you think, work, and live.

1. Find Your Passion

Warren Buffett often says, “You have to love what you do.” He believes passion is the fuel behind extraordinary success. If you wake up excited about your work, you’re far more likely to excel. Buffett didn’t follow the money—he followed his love for investing, and wealth followed naturally. Find the intersection of your interests and strengths, and commit to it wholeheartedly.

2. Hire Well

Buffett surrounds himself with people of integrity, intelligence, and energy. His advice? “You can’t build a good company without good people.” He looks for character above all else. When you hire or partner with the right individuals, trust builds, decisions improve, and success becomes a shared journey. Choose wisely—one wrong hire can damage a team; one right hire can multiply results.

3. Don’t Care What Others Think

Warren Buffett is known for sticking to his principles—even when the crowd disagrees. His investment choices have often gone against public opinion, but his results have spoken louder than criticism. His mindset: focus on the long-term truth rather than short-term noise. Trust your research, values, and judgment. Popular opinion isn’t always the right direction.

4. Read, Read, Read

Buffett reads around 5-6 hours a day. From financial reports to books and newspapers, his secret to success is simple: “The more you learn, the more you earn.” Reading sharpens the mind, deepens knowledge, and builds perspective. Whether you’re in business, parenting, or personal growth, consistent reading will set you apart from the average.

5. Have a Margin of Safety

A key investing principle Buffett borrowed from Benjamin Graham, this concept applies to life as well. Always leave room for error—financially, emotionally, or professionally. Don’t stretch yourself so thin that one failure leads to collapse. Build buffers, save more than you spend, and make decisions with risk in mind. It’s not about being pessimistic—it’s about being wisely prepared.

6. Have a Competitive Advantage

Buffett looks for businesses with a “moat”—something that protects them from competitors. As an individual, your moat could be your unique skill set, character, or network. Identify what makes you different and keep strengthening it. In a crowded world, your edge is what makes you irreplaceable.

7. Schedule for Your Personality

Buffett doesn’t fill his calendar with endless meetings. He leaves time for deep thinking and reflection, aligned with how he operates best. Don’t feel pressured to mimic others’ routines. Know your peak energy hours, your limits, and your preferences. Whether you’re a morning thinker or a quiet strategist, design your day around what brings out your best self.

8. Always Be Competing

In Buffett’s world, standing still means falling behind. But competition doesn’t always mean rivalry—it means always striving to be better than you were yesterday. Learn new skills, adapt, and challenge yourself regularly. The real competition is with your potential.

9. Model Success

Buffett modelled his approach after mentors like Benjamin Graham. He says, “It’s good to learn from your mistakes. It’s better to learn from other people’s mistakes.” Observe people who’ve walked the path you admire. Adopt their mindset, habits, and ethics. This shortcut to wisdom can save you years of trial and error.

10. Give Unconditional Love

Perhaps Buffett’s most surprising advice for a man of finance is deeply emotional. He believes giving and receiving unconditional love is the truest form of wealth. “The truth is, if you get to my age in life and nobody thinks well of you, I don’t care how big your bank account is, your life is a disaster.” Treat people with compassion, humility, and care. In the end, relationships matter more than results.

Warren Buffett’s 10 Golden Rules

Above details and video source: Youtube

Biography Of Warren Buffett

Warren Edward Buffett (/ˈbʌfɪt/; born August 30, 1930) is an American business magnate, investor, speaker and philanthropist who serves as the chairman and CEO of Berkshire Hathaway. He is considered one of the most successful investors in the world and has a net worth of US$82 billion as of July 18, 2019, making him the third-wealthiest person in the world.

Buffett was born in Omaha, Nebraska. He developed an interest in business and investing in his youth, eventually entering the Wharton School of the University of Pennsylvania in 1947 before transferring and graduating from the University of Nebraska at the age of 19.

He went on to graduate from Columbia Business School, where he molded his investment philosophy around the concept of value investing that was pioneered by Benjamin Graham. He attended New York Institute of Finance to focus his economics background and soon after began various business partnerships, including one with Graham.

He created Buffett Partnership, Ltd in 1956 and his firm eventually acquired a textile manufacturing firm called Berkshire Hathaway, assuming its name to create a diversified holding company. In 1978, Charlie Munger joined Buffett and became vice chairman of the company.

Buffett has been the chairman and largest shareholder of Berkshire Hathaway since 1970. He has been referred to as the “Oracle” or “Sage” of Omaha by global media outlets. He is noted for his adherence to value investing and for his personal frugality despite his immense wealth.

Research published at the University of Oxford characterizes Buffett’s investment methodology as falling within “founder centrism” – defined by a deference to managers with a founder’s mindset, an ethical disposition towards the shareholder collective, and an intense focus on exponential value creation. Essentially, Buffett’s concentrated investments shelter managers from the short-term pressures of the market.

Buffett is a notable philanthropist, having pledged to give away 99 per cent of his fortune to philanthropic causes, primarily via the Bill & Melinda Gates Foundation. He founded The Giving Pledge in 2009 with Bill Gates, whereby billionaires pledge to give away at least half of their fortunes.

He endorsed Democratic candidate Hillary Clinton in the 2016 U.S. presidential election and will judge current U.S. President Donald Trump by his results on national safety, economic growth and economic participation when deciding if he will vote for him in the 2020 U.S. presidential election. Source: The article about Warren Edward Buffett on Wikipedia

Warren Buffett’s Success Story

Conclusion

Warren Buffett’s life and success are built not just on brilliant investing strategies, but on timeless personal principles that anyone can adopt. His lessons—like finding your passion, reading constantly, hiring with care, and giving unconditional love—are reminders that true success isn’t measured only by wealth, but by integrity, relationships, and lifelong learning. Whether you’re an entrepreneur, a student, or someone striving for personal growth, these principles can guide you toward a more focused, fulfilling, and meaningful life. By modelling success with humility and purpose, just as Buffett has done, you create not only financial security but also a legacy of wisdom and respect.

Recommended success stories for reading

- Sundar Pichai Google Ceo

- Satya Nadella Microsoft CEO

- Dr. A. P. J. Abdul Kalam

- Sandeep Maheshwari Motivational Speaker

Share the post on your social media network and with friends and relatives.

Photo Credits – Mark Hirschey [CC BY-SA 2.0], via Wikimedia Commons

PVM

Mathukutty P V is a Blogger, YouTuber, and Content Writer who transitioned into a “Free Lifestyle” after choosing voluntary retirement in 2017. He is the founder of Simply Life Tips, a mission-driven platform dedicated to inspiring others through practical wisdom and life lessons. Driven by a love for continuous learning and self-growth, Mathukutty shares knowledge gathered from years of reflection to help his readers live with more purpose and positivity.